Forex Trading Strategies

Introduction to Forex Trading Strategies

When it comes to forex trading, having current and up-to-date information is essential for success. With the ever-changing market conditions, staying informed about the latest trends and developments is crucial for making informed trading decisions. Whether you are a beginner or an experienced trader, understanding different forex trading strategies is crucial to maximize your earning potential.

Fundamental Analysis

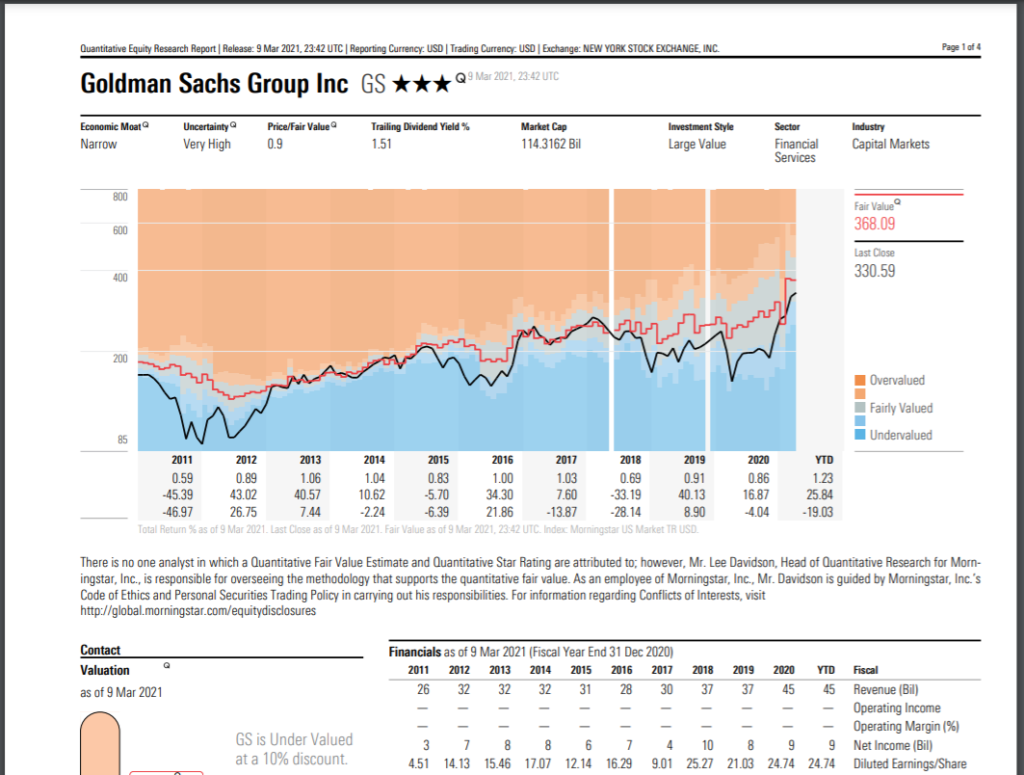

Fundamental analysis involves analyzing economic and political factors that may impact currency value. By examining key indicators such as GDP, interest rates, and employment rates, you can predict how a particular currency will perform in the market.

Technical Analysis

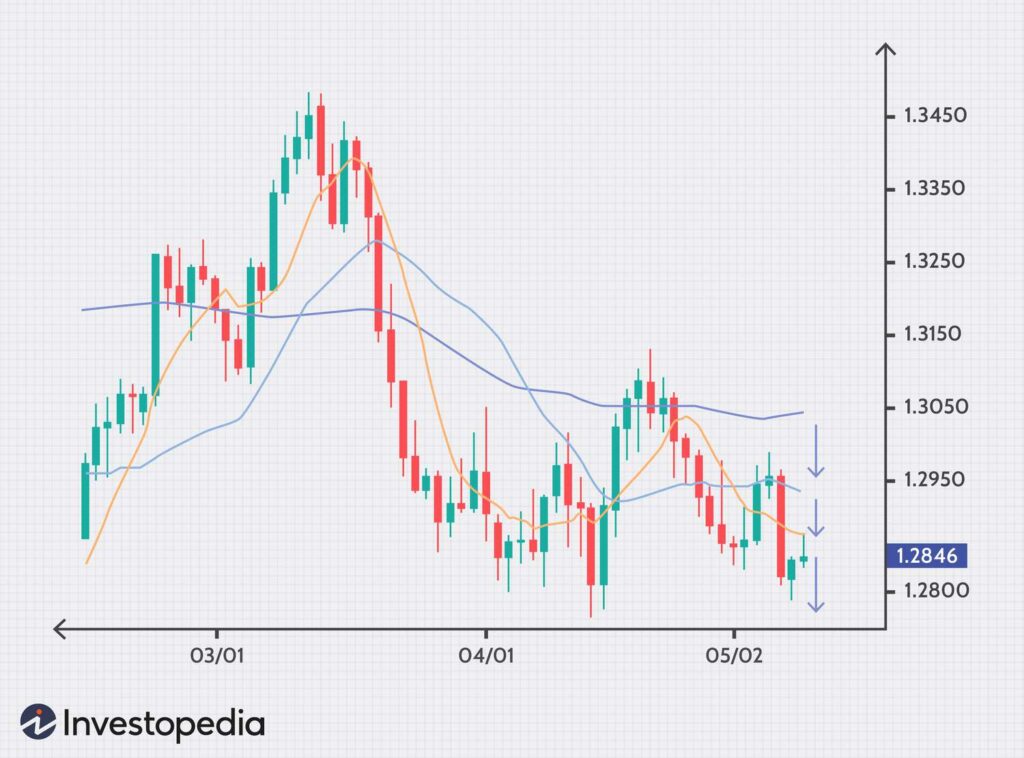

Technical analysis focuses on studying price patterns and market trends to predict future price movements. Traders utilize tools such as moving averages, relative strength index, and stochastic indicators to identify trading opportunities.

Risk Management

Risk management is a vital component of successful forex trading. It involves setting appropriate stop-loss and take-profit levels, managing leverage effectively, and diversifying your portfolio to minimize potential losses.

Trend Following Strategies

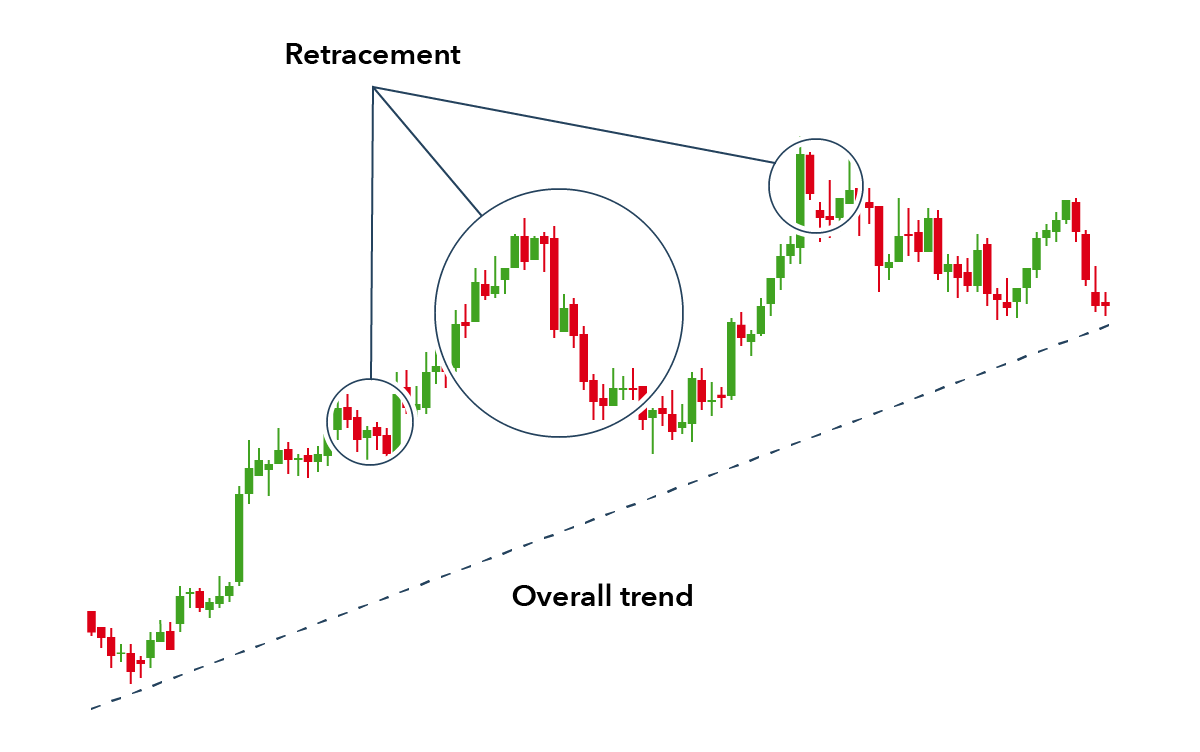

Trend following strategies aim to capitalize on long-term price trends. Traders identify trends using various technical indicators and aim to enter positions in the direction of the prevailing trend.

Range Trading Strategies

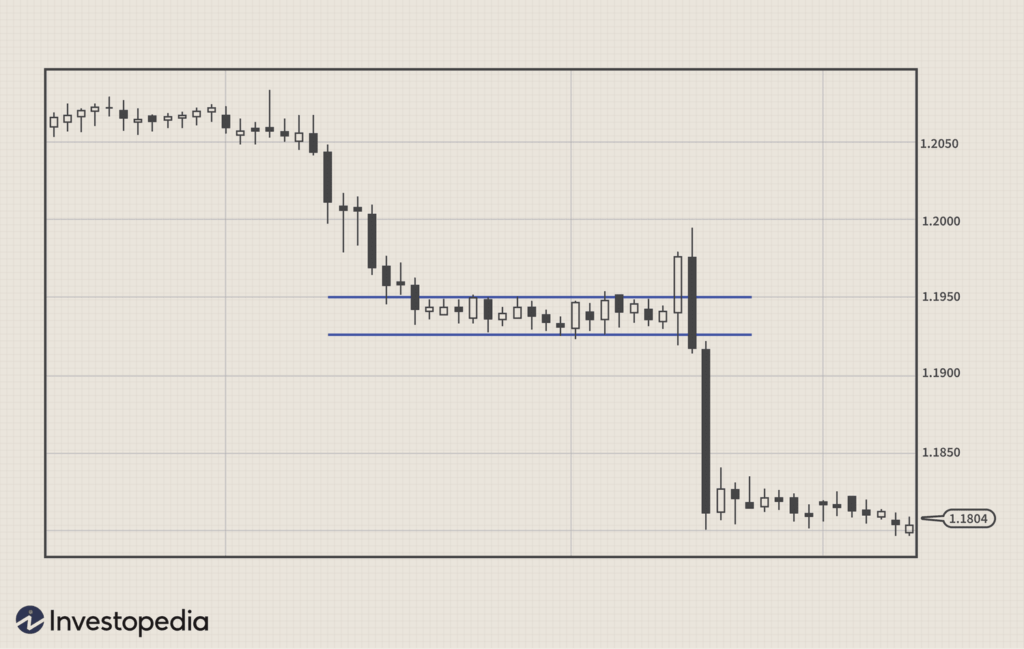

Range trading strategies are suitable for sideways markets where prices are not moving in a clear trend. Traders aim to identify support and resistance levels and take advantage of price fluctuations within the defined range.

Breakout Strategies

Breakout strategies involve identifying key price levels and entering positions when the price breaks out of a defined range. Traders anticipate strong price movements and aim to capitalize on the breakout.

Scalping Strategies

Scalping strategies involve entering and exiting trades quickly to take advantage of small price movements. Traders typically use short timeframes and rely on technical indicators to identify profitable scalping opportunities.

Swing Trading Strategies

Swing trading strategies aim to capture medium-term price movements. Traders identify swing highs and lows and enter positions when the price reverses from these levels.

Carry Trading Strategies

Carry trading strategies rely on interest rate differentials. Traders buy currencies with higher interest rates and sell currencies with lower interest rates to profit from the interest rate differential.

Staying informed about current forex trading strategies is essential for success in the forex market. By understanding fundamental and technical analysis, implementing risk management techniques, and utilizing various trading strategies, you can maximize your earning potential and achieve your financial goals.

## Market Analysis

Importance of market analysis in forex trading

When it comes to forex trading, staying updated with current information is essential. Market analysis allows you to make informed and strategic decisions that can greatly impact your trading success. There are two main types of analysis: fundamental and technical analysis.

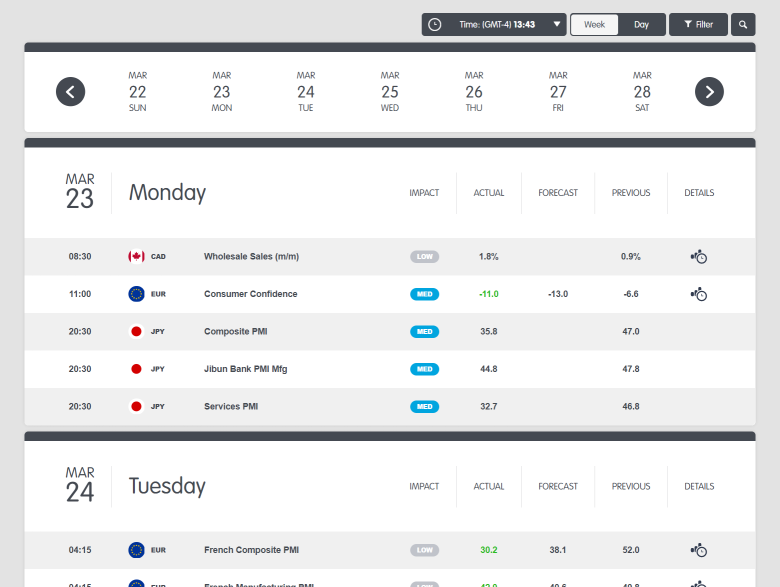

Fundamental analysis focuses on economic indicators, central bank announcements, and political events. By monitoring these factors, you can understand the overall health of a country’s economy and predict how it will affect the value of a particular currency.

Technical analysis, on the other hand, relies on chart patterns, candlestick patterns, support and resistance levels, and trend lines. It helps you identify potential buy or sell signals based on historical price patterns and trends.

By combining both fundamental and technical analysis, you can gain a comprehensive understanding of the forex market and increase your chances of making profitable trades. So, whether you’re a beginner or an experienced trader, don’t underestimate the power of current information in forex trading. Stay updated and make smarter trading decisions.

## Trading Tools

MT4 Terminal (MetaTrader 4)

When it comes to forex trading, staying informed and up-to-date is essential. That’s why having access to current information is crucial for successful trades. One of the most popular trading platforms is the MT4 terminal (MetaTrader 4). Developed by MetaQuotes, this powerful software provides traders with a range of features that can greatly enhance their trading experience.

Introduction to MetaQuotes and its features

MetaQuotes is a leading provider of trading software, and their MT4 terminal is widely used by forex traders worldwide. This platform offers a user-friendly interface that allows you to monitor your trades, read charts, and analyze market trends. In addition, the MT4 strategy tester enables you to backtest your forex strategies, ensuring that they perform well in different market conditions.

How to open an account on MetaTrader 4

Opening an account on MetaTrader 4 is a straightforward process. Simply find a reputable forex broker, make a deposit, and you can begin trading. Once your account is set up, you can start using the MT4 terminal to execute trades and manage your investments.

MetaTrader 4 strategy tester

The strategy tester on MT4 is a valuable tool for traders. It enables you to simulate and test your strategies using historical data. By doing so, you can determine how effective your trading approach is and make any necessary adjustments.

Expert Advisors (EA) and their role in trading

Expert Advisors, also known as EAs, are automated trading systems programmed to execute trades based on predetermined criteria. These tools can analyze the market, identify trading opportunities, and execute trades on your behalf. EAs are popular among traders who want to automate their trading process and minimize emotions in their decision-making.

Forex indicators on MT4

MT4 offers a wide range of forex indicators that can help you make more informed trading decisions. From moving averages to the relative strength index and stochastic oscillator, these indicators provide valuable insights into market trends and help you identify potential entry and exit points.

Using custom indicators

In addition to the built-in indicators, MT4 allows you to use custom indicators created by other traders. These indicators are designed to provide unique insights into the market and can be a valuable addition to your trading arsenal.

Trading signals and copy trading services

If you’re not confident in your own trading skills, you can take advantage of trading signals and copy trading services available on MT4. These services allow you to follow experienced traders’ strategies and automatically copy their trades. This can be a great way to learn from successful traders and potentially boost your profitability.

Automation tools

MT4 also supports automation tools, which allow you to set up and execute trades automatically based on predefined conditions. These tools can be particularly useful if you have a specific trading strategy that you want to implement consistently.

MetaTrader 5 (MT5) and its advancements

While MT4 is widely used, its successor, MetaTrader 5 (MT5), offers even more advanced features and capabilities. With MT5, you can access new markets, such as stocks and commodities, and take advantage of improved trading tools and indicators.

Current information is vital in forex trading, and using the right tools can greatly enhance your trading experience. Whether you choose to use MT4 or its more advanced counterpart, MT5, having access to features like strategy testers, expert advisors, and customizable indicators can greatly increase your chances of success in the forex market.

## Selecting a Forex Broker

Importance of choosing the right forex broker

When it comes to forex trading, staying informed is crucial. With the abundance of current information available, you can make informed decisions and increase your chances of success. One key aspect of forex trading is selecting the right forex broker. This decision can greatly impact your trading experience and overall profitability.

Regulation and licensing

When choosing a broker, it is essential to consider regulation and licensing. A regulated broker ensures that your funds are secure and that the trading environment is fair. Look for brokers regulated by reputable authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). It is important to verify the broker’s licensing and understand the regulations they abide by.

Account types and conditions

Different brokers offer various account types and conditions. Consider the type of trading you plan to engage in and choose a broker that aligns with your trading goals. Some brokers offer demo accounts for beginners to practice their trading strategies, while others provide live accounts for experienced traders. Review the account conditions such as minimum deposit requirements, leverage, and spreads to ensure they suit your trading style.

Spreads and commissions

Spreads and commissions can significantly impact your trading costs. Spreads refer to the difference between the buy and sell price, and lower spreads indicate better trading conditions. Some brokers charge commissions on each trade, so it’s important to consider these fees and compare them with other brokers.

Leverage and margin requirements

Leverage allows you to trade larger positions with a smaller amount of capital. However, it is important to understand the risks associated with leverage. Consider the leverage options offered by the broker and ensure they align with your risk tolerance. Additionally, review the margin requirements, as these determine the minimum amount of capital required to hold a position.

Trading platforms and tools

A user-friendly and reliable trading platform is essential for efficient trading. Look for brokers that offer popular platforms such as MetaTrader 4 or MetaTrader 5. These platforms provide advanced charting tools, indicators, and expert advisors to enhance your trading experience. Additionally, consider if the broker offers mobile trading options, as this allows you to monitor trades on the go.

Deposit and withdrawal options

Review the deposit and withdrawal options provided by the broker. Ensure they offer convenient and secure methods that suit your preferences. Look for brokers that support various payment gateways and offer fast withdrawal processing times.

Customer support

Reliable customer support is crucial in forex trading. Look for brokers that offer 24/7 customer support and provide multiple channels of communication such as phone, email, or live chat. Quick response times and knowledgeable support agents can greatly assist you in resolving any queries or issues promptly.

User reviews and reputation

Lastly, consider the reputation and user reviews of the broker. Take the time to research and read reviews from other traders. This will provide you with insights into the broker’s reliability, customer service, and overall performance. However, it’s important to take reviews with a grain of salt and consider multiple sources.

Selecting the right forex broker is essential for successful trading. Consider factors such as regulation, account types, spreads, leverage, trading platforms, customer support, and user reviews when making your decision. Conduct thorough research and choose a broker that aligns with your trading goals and preferences. Remember, the right broker can provide you with the necessary tools and support to navigate the forex market effectively.

## Popular Currency Pairs

Introduction to major, minor, and exotic currency pairs

When it comes to forex trading, staying up-to-date with current information is crucial for success. One way to do this is by focusing on popular currency pairs. These pairs are typically the most liquid and widely traded, making them a prime choice for traders. To understand currency pairs, it is important to know their codes and symbols. For example, USDJPY represents the U.S. Dollar against the Japanese Yen. CHFJPY refers to the Swiss Franc in relation to the Japanese Yen, while GBPJPY represents the British Pound against the Japanese Yen.

Focus on JPY (Japanese Yen) trading

JPY trading has gained considerable popularity due to its high volatility and potential for profit. Traders often closely monitor the USDJPY, CHFJPY, and GBPJPY pairs for trading opportunities. To make informed trading decisions, it is essential to analyze the factors that influence yen pairs. This can be achieved through technical analysis, which involves studying price movements and market trends to predict future price movements.

Trading strategies for yen pairs

Various trading strategies can be employed when trading yen pairs. For example, some traders use moving averages or the relative strength index (RSI) to identify entry and exit points. Others may rely on stochastic indicators or implement stop orders to manage risk. Regardless of the strategy used, it is important to understand and test the strategy using tools such as the MT4 strategy tester. By staying informed on current information and utilizing effective trading strategies, you can increase your chances of success in forex trading. Remember, trading forex involves risks, and it is crucial to always conduct thorough research before making any trading decisions.

Earning Potential in Forex Trading

Exploring income possibilities in forex trading

When it comes to forex trading, staying informed about the current market trends and the latest developments is crucial. Without up-to-date information, it can be challenging to make profitable trading decisions. The forex market is constantly changing, with currency values fluctuating based on various economic factors. By staying connected to current information, you empower yourself to make informed and strategic trades.

Making thousands of dollars per month

Forex trading offers the potential to generate substantial income. Many traders have successfully made thousands of dollars per month by honing their skills and employing effective strategies. With a wide range of currency pairs to trade, such as USDJPY, CHFJPY, and GBPJPY, there are ample opportunities to profit from market fluctuations.

Strategies for consistent profits

Consistency is key in forex trading. By developing and implementing a solid trading strategy, you can position yourself for consistent profits. Technical analysis and the use of indicators like moving averages, relative strength index (RSI), and stochastic can help you identify favorable trends and execute trades with higher accuracy.

Achieving a $10,000/month income

If you aspire to earn $10,000 per month through forex trading, it is important to set realistic goals and gradually scale up your trading activities. By carefully managing your investments and taking calculated risks, you can work towards achieving this income milestone.

Scaling up to a $100,000 income

For those ambitious traders seeking even greater earning potential, scaling up to a $100,000 income is possible with dedication and skill. As you gain experience and refine your trading strategies, you can steadily increase your investment amounts and take advantage of larger market opportunities.

Realistic expectations and risk management

While the earning potential in forex trading is appealing, it is essential to maintain realistic expectations and exercise proper risk management. The forex market is inherently volatile, and losses are a part of the trading journey. By carefully managing your trades, setting stop orders, and employing limit orders, you can minimize risks and optimize your chances of success.

Importance of continuous learning and improvement

To thrive in forex trading, it is crucial to embrace continuous learning and improvement. Stay updated with the latest news, market analysis, and trading strategies. Utilize resources from reputable sources like Alpari.org, Forex.com, and Forex Factory. By consistently learning and adapting your trading approach, you can enhance your skills and increase your chances of achieving long-term success.

By staying informed about current information, developing effective strategies, and maintaining realistic expectations, you can unlock the earning potential in forex trading and work towards achieving your financial goals. Remember, forex trading is not a guaranteed pathway to wealth, but with dedication, perseverance, and a constant thirst for knowledge, you can strive towards financial success.

Learn to Trade Forex

Importance of education and learning in forex trading

When it comes to forex trading, staying up-to-date with current information is crucial. This industry is constantly evolving, and being well-informed can make a significant difference in your trading decisions. Knowledge is power, and staying ahead of the game can help you maximize your profits and minimize your risks.

Forex trading courses and resources

One of the best ways to acquire the knowledge and skills needed for successful forex trading is by enrolling in forex trading courses. These courses provide comprehensive education on various aspects of the forex market, including strategies, technical analysis, and risk management. Additionally, there are numerous online resources such as books, eBooks, and articles that can supplement your learning. By taking advantage of these resources, you can gain a solid foundation and increase your chances of success.

Webinars and seminars

Participating in webinars and seminars is another excellent way to enhance your forex trading skills. These virtual or in-person events allow you to learn from experienced traders who share their insights and strategies. They provide an opportunity for interactive learning, where you can ask questions and engage in discussions with experts and fellow traders.

Trading communities and forums

Joining trading communities and forums can greatly expand your knowledge and provide valuable insights. These platforms allow you to connect with like-minded individuals, exchange ideas, and learn from each other’s experiences. Engaging in discussions and staying active within these communities can give you a fresh perspective and help you stay updated with the latest trends and developments in the forex market.

Demo trading and practice accounts

It’s important to practice your trading skills before risking real money. Demo trading and practice accounts allow you to trade in a simulated environment using virtual funds. This gives you an opportunity to test different strategies, understand market movements, and gain practical experience without any financial risk. By utilizing these accounts, you can fine-tune your trading skills and build confidence before transitioning to live trading.

Mentorship and coaching programs

Working with a mentor or joining a coaching program can be immensely beneficial for novice traders. Seasoned traders who have already achieved success can provide invaluable guidance and support. They can teach you effective trading strategies, help you overcome challenges, and offer personalized advice based on your individual trading style and goals. Mentorship programs and coaching sessions can accelerate your learning curve and help you avoid common trading mistakes.

Developing a trading plan and journal

A well-defined trading plan is essential for consistent profitability. It outlines your trading goals, entry and exit criteria, risk management rules, and other important factors. By creating a trading plan and journal, you can systematically track your trades, analyze your successes and failures, and refine your strategies accordingly. This process of self-reflection and evaluation is vital for continuous improvement and long-term success in forex trading.

Continuous learning and skill enhancement

Forex trading is a dynamic and ever-changing field. To stay ahead of the curve, it’s crucial to continuously learn and enhance your skills. Keep yourself updated with the latest industry news, market trends, and economic indicators. Explore new strategies and trading tools. Attend workshops, read educational materials, and participate in relevant training programs. By embracing a mindset of continuous learning, you can adapt to market dynamics and continuously refine your trading approach.

Learning to trade forex is a journey that requires dedication and a thirst for knowledge. By recognizing the importance of education, leveraging available resources, and continuously enhancing your skills, you can increase your chances of success in this thrilling and potentially lucrative industry.

## Types of Orders in Forex Trading

Introduction to order types

When it comes to forex trading, having access to current information is crucial in making informed decisions. The forex market is highly dynamic, and staying up to date with the latest trends and news can greatly impact your trading outcomes.

Market order and its execution

A market order is an order to buy or sell a currency at the current market price. It is executed instantly and ensures quick execution without delay. Market orders are ideal for traders who want to enter or exit a position quickly, without worrying about the price changing.

Limit order and its benefits

A limit order allows you to set a specific price at which you want to buy or sell a currency. This type of order can be useful when you believe that the price will reach a certain level before executing the trade. By setting a limit order, you can ensure that you enter or exit the market at your desired price.

Stop order and its usage

A stop order, also known as a stop-loss order, is used to limit your losses in a trade. It allows you to set a specific price at which you want to exit the market if the trade goes against you. Stop orders are essential for risk management and protecting your capital.

Trailing stop order for risk management

A trailing stop order is a type of stop order that automatically adjusts as the market price moves in your favor. It allows you to protect your profits by locking in gains while giving the trade room to grow. Trailing stop orders are effective for managing risk and maximizing potential returns.

OCO (One Cancels Other) order

An OCO order is a combination of two orders: a stop order and a limit order. With an OCO order, when one order is executed, the other is automatically canceled. This type of order allows you to set both a profit target and a stop-loss level simultaneously.

IFD (If Done) order

An IFD order is a combination of two orders: an entry order and a stop order or limit order. The entry order is executed when the specified conditions are met, and if done, the stop or limit order is activated. IFD orders provide flexibility and allow you to plan your trades in advance.

Hidden orders

Hidden orders are orders that are not displayed in the market depth or order book. These orders are not visible to other traders and help maintain anonymity. Hidden orders are useful when you want to execute large trades without impacting the market.

Good ‘Till Cancelled (GTC) order

A GTC order allows you to set an order that remains active until it is either executed or canceled. This type of order is useful for traders who want to enter the market at specific price levels but may not be constantly monitoring the market.

Immediate or Cancel (IOC) order

An IOC order is an order that is immediately executed or canceled. If the order cannot be filled immediately, it is automatically canceled. IOC orders ensure quick execution and are suitable for traders who want to take advantage of immediate price opportunities.

Understanding the different types of orders in forex trading is crucial for maximizing your trading success. By utilizing the appropriate order types based on your trading strategy, risk tolerance, and market conditions, you can effectively manage your trades and increase your chances of profitability. Stay informed, make informed decisions, and remember to always practice proper risk management techniques.

Technical Analysis Tools

Introduction to Technical Analysis

In the ever-changing world of forex trading, staying up to date with current information is crucial for your success. One of the most important aspects of trading is technical analysis. By using various tools and indicators, you can make informed decisions and enhance your trading strategies.

Moving Averages and Their Interpretation

Moving averages are popular indicators used in forex trading. They help smooth out price data and identify trends. By analyzing the relationship between different moving averages, you can determine potential entry and exit points for your trades.

MACD (Moving Average Convergence Divergence)

The MACD is a versatile indicator that combines moving averages and helps identify trend reversals, momentum shifts, and potential buy or sell signals. Understanding how to interpret the MACD can greatly enhance your trading decisions.

RSI (Relative Strength Index)

The RSI is a momentum oscillator that measures the speed and change of price movements. It helps identify overbought or oversold conditions, indicating potential price reversals. Incorporating RSI into your analysis can provide valuable insights for timing your trades.

Fibonacci Retracement Levels

Fibonacci retracement levels are based on a mathematical sequence and are used to identify potential support and resistance levels. By incorporating these levels into your analysis, you can anticipate price retracements and potential entry or exit points.

Bollinger Bands

Bollinger Bands are volatility indicators that help identify price overbought or oversold conditions. By analyzing the widening or narrowing of the bands, you can anticipate potential price breakouts or reversals.

Stochastic Oscillator

The stochastic oscillator is a momentum indicator that compares current price levels to their range over a certain period. It helps identify overbought or oversold conditions, indicating potential trend reversals or continuations.

Ichimoku Cloud

The Ichimoku Cloud is a comprehensive indicator that provides insights into support and resistance levels, trend direction, and momentum. By understanding the different components of the cloud, you can make more informed trading decisions.

Pivot Points

Pivot points are price levels calculated based on previous high, low, and close prices. They help identify potential support and resistance levels, indicating price reversals or continuations. Incorporating pivot points into your analysis can improve your trading decisions.

Volume Analysis

Volume analysis helps assess the strength or weakness of price movements by analyzing the volume of trades. By understanding the relationship between volume and price, you can confirm or question the validity of price trends or reversals.

Understanding and utilizing technical analysis tools is essential for successful forex trading. By incorporating these tools into your analysis, you can enhance your trading strategies and increase your chances of making profitable trades. Stay informed, use the right tools, and keep practicing to improve your trading skills.

Reliable Online Resources for Forex Trading

Introduction to Reliable Online Resources

When it comes to forex trading, staying up-to-date with current information is crucial for success. Luckily, there are several reputable online resources available that can provide you with the latest market insights and trading analysis. These platforms offer a wide range of tools and educational resources to help you make informed trading decisions and maximize your profits.

Alpari (www.alpari.org)

Alpari is a well-established forex broker that provides valuable resources for traders. Their website offers real-time market data, including live quotes and charts, to help you monitor trades and make informed decisions. Additionally, Alpari offers educational materials and forums where you can learn from experienced traders and gain valuable insights.

Forex.com (www.forex.com)

Forex.com is another reputable platform that offers a range of resources for forex traders. With access to real-time market data, research tools, and analysis, Forex.com can help you stay on top of market trends. They also provide educational resources and forums where you can interact with other traders and gain valuable knowledge.

Forex Factory (www.forexfactory.com)

Forex Factory is a popular online resource for traders of all levels. The platform provides a wide range of tools, including economic calendars, to help you stay informed about important market events. Additionally, Forex Factory offers forums where you can connect with other traders, share ideas, and gain insights into successful trading strategies.

Benefits of Using Reputable Platforms

By utilizing these reliable online resources, you can gain several advantages in your forex trading journey. Firstly, access to real-time market data allows you to stay informed about price movements and make timely trading decisions. The trading analysis and research tools provided by these platforms can also help you identify profitable trading opportunities and make informed trading strategies. Additionally, the educational resources and forums offered by these platforms enable you to continually improve your trading skills, learn from experienced traders, and stay updated with the latest trends in the market. Lastly, the community support and networking opportunities provided by these platforms allow you to connect with like-minded individuals, share ideas, and gain valuable insights from the trading community.

In conclusion, reliable online resources such as Alpari, Forex.com, and Forex Factory are invaluable tools for forex traders looking to stay informed and make profitable trading decisions. By utilizing these platforms, you can access real-time market data, analysis tools, educational resources, and networking opportunities. So, take advantage of these reputable resources and enhance your forex trading experience today.