Forex Trading: Asian Session

Introduction to the Asian Session

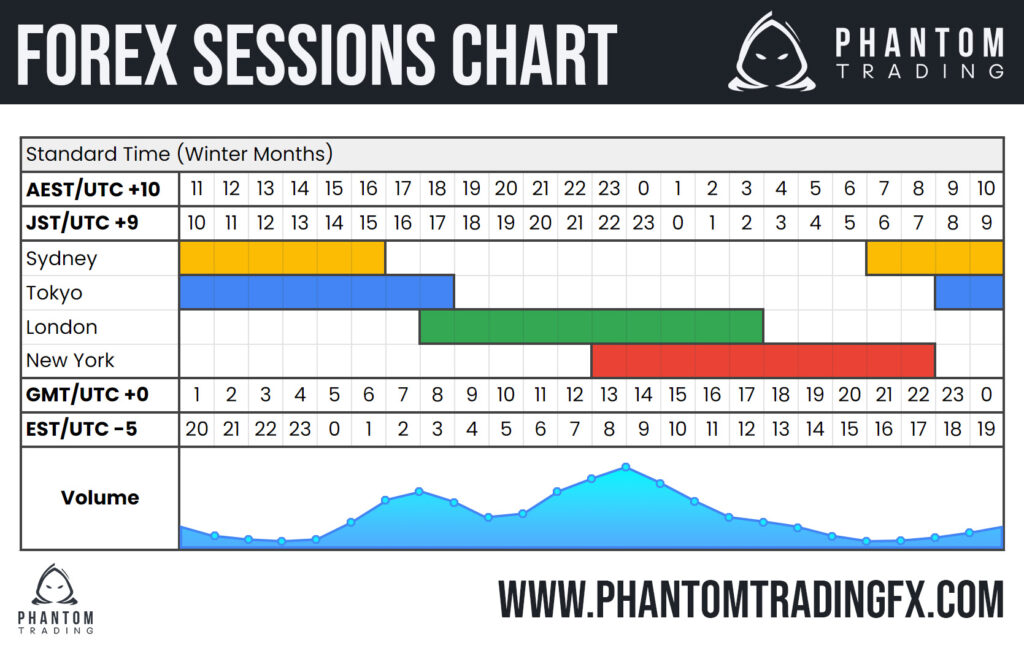

In the world of forex trading, the Asian session plays a significant role as it sets the tone for the trading day. Spanning from the opening of the Tokyo market (12:00 AM GMT) until the European session takes over (8:00 AM GMT), this session offers unique opportunities for traders looking to take advantage of the volatility in the Asian markets.

Characteristics of the Asian Session

During the Asian session, liquidity may be lower compared to the European or New York sessions, resulting in less volatile price movements. However, it’s important to note that certain economic news releases or events happening during this session can still cause significant price fluctuations. Traders should stay informed of any upcoming events to make informed trading decisions.

Major Currency Pairs in the Asian Session

The Asian session predominantly involves currency pairs such as USD/JPY, CHF/JPY, and GBP/JPY. These pairs are heavily influenced by the Japanese yen, making them ideal for traders interested in the Asian markets.

Best Strategies for Trading in the Asian Session

When trading during the Asian session, it’s crucial to have a well-defined strategy. Some popular strategies include trading breakouts, using moving averages, or employing technical indicators such as the Relative Strength Index (RSI) or Stochastic oscillator. These strategies can help you identify potential entry and exit points in the market.

Forex Brokers with Strong Asian Session Offerings

To make the most of the Asian session, it’s essential to choose a reliable forex broker. Look for brokers who offer competitive spreads, fast execution, and a wide range of currency pairs specifically tailored for the Asian session. Websites such as Alpari, Forex.com, and Forex Factory provide useful information about top forex brokers.

Tools and Resources for Trading the Asian Session

To improve your trading experience during the Asian session, various tools and resources are available. Take advantage of forex trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which offer features such as real-time charting, technical analysis tools, and the ability to monitor trades. Additionally, stay updated with economic calendars, news websites, and forums to stay informed about market events.

Technical Indicators for Asian Session Trading

Technical indicators are key to analyzing price movements during the Asian session. Moving averages, for example, can help identify trends, while the Commodity Channel Index (CCI) can indicate overbought or oversold conditions. Experiment with different indicators and find the ones that work best for your trading style.

Tips and Tricks for Successful Asian Session Trading

To succeed in the Asian session, consider the following tips and tricks:

- Focus on the major currency pairs.

- Pay attention to economic news releases.

- Use appropriate risk management techniques.

- Utilize demo accounts to practice and refine your strategies.

- Learn from experienced traders and continuously educate yourself.

Common Mistakes to Avoid in Asian Session Trading

Avoid common pitfalls by refraining from the following:

- Trade without a well-defined strategy.

- Overtrade during low-liquidity periods.

- Neglect to set stop-loss and take-profit levels.

- Ignore economic news and market events.

- Let emotions dictate your trading decisions. Welcome to the world of forex trading! In this article, we will dive into the Asian session, a crucial time period in forex trading. Whether you are a beginner or an experienced trader, understanding the dynamics of the Asian session is essential to maximize your trading opportunities.

What is the Asian Session?

The Asian session refers to the period when the Asian markets are open for trading. It starts with the opening of the Tokyo market and includes trading activity in countries such as Japan, China, Australia, and New Zealand. This session is known for its unique characteristics and provides distinct opportunities to traders.

Trading Hours of the Asian Session

The Asian session typically begins at 00:00 GMT and lasts until 09:00 GMT. It overlaps with the end of the New York session and the start of the European session. During this time, market activity is relatively slow compared to other sessions, but it can still present favorable trading conditions for certain currency pairs.

Importance of the Asian Session in Forex Trading

Despite its comparatively lower volatility, the Asian session plays a significant role in the forex market. It sets the tone for the day and can dictate the direction and sentiment of major currency pairs. Traders often use this time to monitor trades, read charts, and analyze key indicators to make informed trading decisions.

With its influence on currency pairs like USD/JPY, CHF/JPY, and GBP/JPY, the Asian session provides ample opportunities to profit. By understanding the unique characteristics and trading patterns during this session, you can enhance your trading strategies and potentially make thousands of dollars every month.

So, get ready to explore the Asian session and seize the opportunities it presents for successful forex trading. Remember to stay informed, practice sound risk management, and constantly refine your trading skills to maximize your profits. Happy trading!

The Asian session in forex trading refers to the period when the markets in Asia are open. It starts at 11:00 PM GMT and ends at 8:00 AM GMT. This session is known for its unique characteristics, which can influence trading strategies and outcomes.

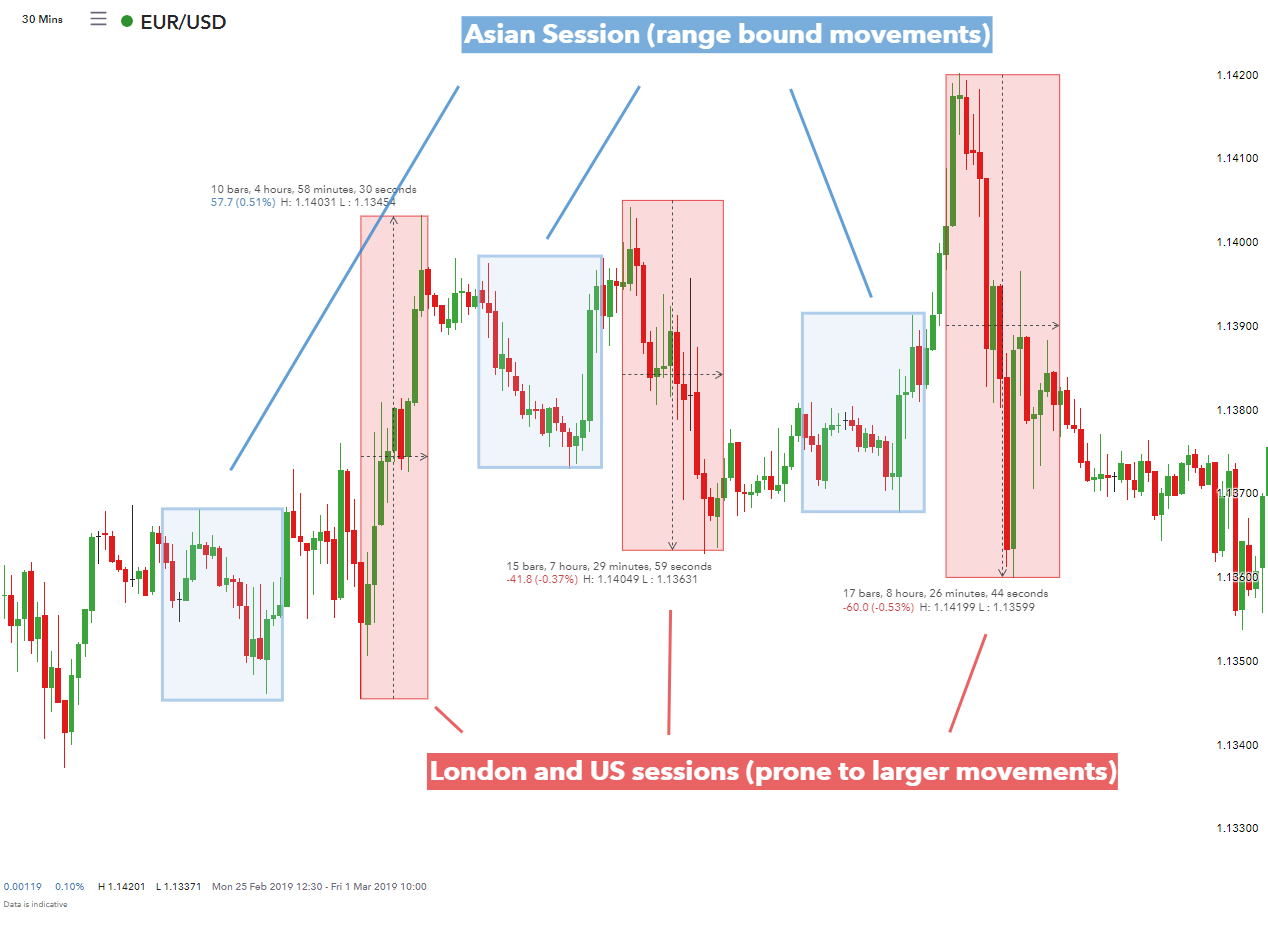

Low Market Volatility

During the Asian session, market volatility tends to be relatively low compared to other sessions. This is because major financial centers like London and New York are closed, resulting in reduced trading volumes. As a result, price movements may be less pronounced, making it challenging to capitalize on short-term fluctuations.

Lack of Major Economic News

Another characteristic of the Asian session is the absence of major economic news releases. This means that there is generally less market-moving data being released during this time. Consequently, traders may need to rely more on technical analysis rather than fundamental factors to inform their trading decisions.

Influence of the Japanese Yen

The Asian session is strongly influenced by the Japanese Yen (JPY). As Japan is a major economic powerhouse, any news or events impacting the country can have a significant impact on JPY currency pairs such as USDJPY, CHFJPY, and GBPJPY. Traders focusing on these pairs will need to stay informed about events and policies related to the Bank of Japan and the Japanese economy.

Liquidity Conditions in the Asian Session

Liquidity in the Asian session can vary depending on the currency pair being traded. While major pairs like USDJPY may have sufficient liquidity, trading in exotic currency pairs might face liquidity challenges. It is important to consider liquidity conditions when placing trades to avoid slippage and unexpected price fluctuations.

The Asian session offers unique trading conditions characterized by low market volatility, a lack of major economic news, the influence of the Japanese Yen, and varying liquidity levels. Traders need to adapt their strategies accordingly to maximize their chances of success during this session.

USD/JPY (UsdJpy)

In the Asian session, one of the major currency pairs that traders often focus on is USD/JPY (UsdJpy). The USD/JPY pair represents the exchange rate between the US dollar and the Japanese yen. As the Asian markets open, there is usually high volatility in this pair, providing ample opportunities for traders to make profits.

CHF/JPY (ChfJpy)

Another significant currency pair during the Asian session is CHF/JPY (ChfJpy). This pair represents the exchange rate between the Swiss franc and the Japanese yen. The Asian session offers traders the chance to take advantage of the fluctuating prices of these two currencies and capitalize on potential profits.

GBP/JPY (GbpJpy)

Lastly, GBP/JPY (GbpJpy) is another major currency pair that attracts attention during the Asian session. It represents the exchange rate between the British pound and the Japanese yen. As the session begins, traders closely monitor this pair for any significant market movements that can be leveraged to generate profits.

The Asian session provides favorable conditions for trading these major currency pairs, as the volatility and liquidity levels are relatively high. By carefully analyzing the market and applying effective strategies, you can potentially make significant gains in the forex market during this session. The Asian session is an important time to trade forex, as it overlaps with the European and U.S. sessions, providing ample opportunities for profit. In this article, we will explore some of the best strategies for trading during the Asian session.

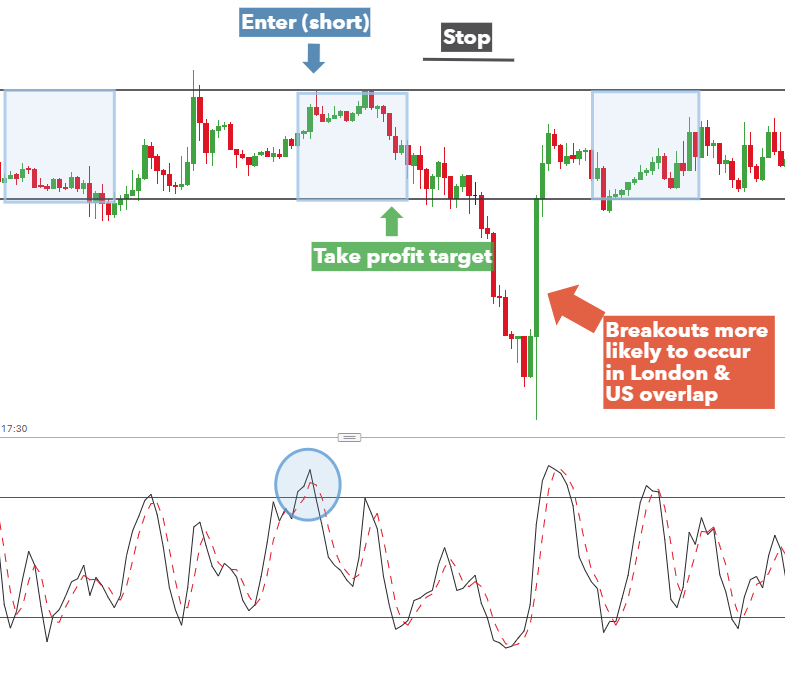

Range Trading

Range trading is a popular strategy during the Asian session, as currency pairs tend to consolidate and trade within a defined range. You can identify these ranges by looking for horizontal support and resistance levels on the charts. By buying at support and selling at resistance, you can profit from the price oscillations within the range.

Breakout Trading

Breakout trading involves entering trades when the price breaks above or below a significant level of support or resistance. During the Asian session, the lack of volatility can sometimes lead to price consolidations. However, when a breakout occurs, it can result in significant price movements. By placing pending orders just above or below these key levels, you can take advantage of these breakout opportunities.

Carry Trade

The Asian session is particularly suitable for carry trade strategy. This strategy involves taking advantage of the interest rate differential between currencies. During this session, the Bank of Japan (BOJ) sets its interest rate policy, which can impact the Japanese Yen (JPY). Traders often borrow low-yielding currencies, such as JPY, to invest in higher-yielding currencies, earning interest differentials. By monitoring economic news and interest rate announcements, you can identify potential carry trade opportunities.

The Asian session offers unique trading opportunities with its distinct characteristics. By employing the range trading, breakout trading, and carry trade strategies, you can maximize your chances of success during this session. Remember to always practice proper risk management and stay updated with the latest market news and analysis. The Asian session in forex trading holds great potential for traders looking to capitalize on the volatility of the Asian markets. To make the most of this session, it is crucial to partner with a reliable and reputable forex broker that offers strong Asian session offerings. Here are three forex brokers that excel in this area.

Alpari

Alpari is a well-established and trusted forex broker that provides traders with a comprehensive range of trading instruments and services during the Asian session. With their MetaTrader 4 terminal, you can easily open an account and access powerful trading tools such as the MT4 strategy tester and expert advisors. Alpari also offers a wide range of currency pairs, including USDJPY, CHFJPY, and GBPJPY, allowing you to take advantage of the fluctuations in these currencies.

Forex.com

Forex.com is another top-notch forex broker that offers a strong lineup of Asian session trading opportunities. With their user-friendly platform, you can quickly make deposits, monitor your trades, and read charts to make informed decisions. Forex.com also provides access to a variety of technical analysis tools and indicators, including moving averages and the relative strength index (RSI), to help you refine your trading strategies.

Forex Factory

If you’re an avid forex trader seeking timely and accurate information during the Asian session, look no further than Forex Factory. This online platform provides a wealth of resources, including real-time market news, economic calendars, and interactive charts, to keep you informed and ahead of the game. By staying updated with Forex Factory, you can identify potential trading opportunities and make well-informed decisions that align with the movements of currency pairs like USDJPY.

Partnering with a reputable forex broker that offers strong Asian session offerings is essential for success in forex trading. Whether you choose Alpari, Forex.com, or utilize the resources of Forex Factory, you can enhance your trading experience and increase your chances of earning profits during the Asian session. So, take advantage of these platforms and start making your mark in the forex market today. The Asian session in forex trading provides numerous opportunities for traders to capitalize on the movements of various currency pairs, particularly those involving the Japanese Yen. To make the most of these trading opportunities, it is essential that you have the right tools and resources at your disposal.

MT4 Terminal

The MT4 terminal is a popular trading platform used by millions of forex traders worldwide. Its user-friendly interface allows you to monitor your trades in real-time, read charts, and execute orders with ease. With the ability to customize indicators and expert advisors (EAs), the MT4 terminal offers a comprehensive solution for trading during the Asian session.

Metaquotes

Metaquotes provides the Metaorder 4 (MT4) and Metaorder 5 (MT5) trading platforms, which are widely used by both beginner and experienced traders. These platforms offer advanced features such as strategy testing and optimization, allowing you to refine your trading strategies before implementing them in the live market.

MT4 Strategy Tester

The MT4 Strategy Tester is an invaluable tool for forex traders looking to backtest their strategies. With this feature, you can simulate trades based on historical price data, enabling you to evaluate the effectiveness of your trading approach in different market conditions.

Forex Indicators

Forex indicators are essential tools for technical analysis, helping you identify trends, patterns, and potential entry and exit points. Popular indicators include moving averages, relative strength index (RSI), stochastic oscillator, and commodity channel index (CCI). By utilizing these indicators effectively, you can enhance your trading decision-making process.

Expert Advisors (EAs)

Expert advisors, also known as EAs, are automated trading systems that execute trades on your behalf based on predefined rules. These EAs can be programmed to take advantage of specific strategies and market conditions, making them a valuable asset for traders who favor algorithmic trading.

To maximize your trading success during the Asian session, it is crucial to equip yourself with the right tools and resources. The MT4 terminal, Metaquotes platforms, MT4 Strategy Tester, forex indicators, and expert advisors are all essential elements that can significantly enhance your trading strategies and outcomes. When it comes to forex trading during the Asian session, having the right technical indicators can greatly enhance your chances of success. The Asian session is known for its unique market conditions and trading opportunities, so it’s important to equip yourself with the tools that can help you navigate this time period effectively.

Moving Averages

Moving averages are one of the most popular indicators used by forex traders. They help identify trends and provide insight into potential entry and exit points. During the Asian session, using moving averages can help you visualize the overall direction of the market and determine whether it’s a good time to buy or sell.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) measures the speed and change of price movements. By analyzing overbought and oversold levels, the RSI can help you identify potential reversals or continuations in the market. This can be particularly useful during the Asian session when price movements can be more subdued.

Stochastic

The stochastic oscillator is another popular momentum indicator. It compares the closing price of a currency pair to its price range over a specified period of time. By identifying overbought and oversold conditions, the stochastic can help you make informed decisions about when to enter or exit trades during the Asian session.

Commodity Channel Index (CCI)

The Commodity Channel Index (CCI) is an oscillator that measures the deviation of a currency pair’s price from its average. By identifying overbought and oversold conditions, the CCI can help you spot potential trading opportunities during the Asian session. It’s particularly useful for traders who prefer to take advantage of range-bound market conditions.

Exponential Averages

Exponential averages are a type of moving average that give more weight to recent price data. They can help you identify short-term trends and determine optimal entry and exit points during the Asian session. By focusing on recent price movements, exponential averages can provide a clearer picture of the current market conditions and potential trading opportunities.

Having the right technical indicators can greatly improve your forex trading experience during the Asian session. Moving averages, RSI, stochastic, CCI, and exponential averages are all valuable tools that can help you analyze the market, spot trends, and make informed trading decisions. Experiment with these indicators and find the ones that work best for your trading strategy during the Asian session. Happy trading!

The Asian session in forex trading is a period of time when the markets in Asia are open. It is important to have a solid understanding of the Asian session as it can provide opportunities for profitable trades. In this section, we will discuss some tips and tricks to help you navigate the Asian session effectively.

Monitor Trades Closely

During the Asian session, it is crucial to closely monitor your trades. The market can be relatively quiet during this time, which means that price movements may be more subtle. Keep a close eye on your trades and be prepared to make quick decisions if necessary.

Read Charts and Analyze Patterns

To make informed trading decisions during the Asian session, it is essential to read charts and analyze patterns. Look for trends, support and resistance levels, and other technical indicators that can help guide your trading strategy.

Set Appropriate Entry and Exit Points

When trading during the Asian session, it is important to set appropriate entry and exit points. Take into consideration the volatility of the market during this time and set your levels accordingly.

Use Risk Management Strategies

Regardless of the trading session, it is crucial to use risk management strategies to protect your capital. Set stop-loss orders and consider your risk-reward ratio before entering any trades.

By following these tips and tricks, you can increase your chances of success during the Asian session. Remember to always stay informed, make educated decisions, and manage your risk effectively. Happy trading!

## Conclusion and Final Thoughts

Summary of the Asian Session

The Asian session in forex trading refers to the period when the markets in Asia, particularly Japan, are active. This session begins with the opening of the Tokyo market and overlaps with the closing of the European market. During this time, currency pairs involving the Japanese yen, such as USD/JPY, CHF/JPY, and GBP/JPY, are often traded.

Benefits and Challenges of Trading in the Asian Session

One of the major benefits of trading during the Asian session is the potential for volatility due to the economic news releases from Japan and other Asian countries. This volatility can create profitable trading opportunities, especially for those who are skilled in technical analysis. Additionally, trading during this session allows you to take advantage of the time difference if you are located in a different timezone.

However, there are also challenges to consider. The lower liquidity during the Asian session may result in wider spreads and slippages. Furthermore, market activity might be slower compared to other sessions, which can limit the number of trading opportunities available.

Key Takeaways for Successful Asian Session Trading

To trade successfully during the Asian session, it is crucial to stay updated with economic news releases from Japan and other Asian countries. Additionally, understanding how to analyze charts, use indicators, and implement your trading strategy effectively is essential. As with any trading session, risk management and discipline are key.

Overall, the Asian session can provide potential trading opportunities for those willing to adapt to its unique characteristics. By staying informed, honing your skills, and maintaining a disciplined approach, you can increase your chances of success during the Asian session. Remember to always evaluate your trades and make adjustments as necessary.

Happy trading!