Understanding Leverage in Forex Trading

What is Leverage?

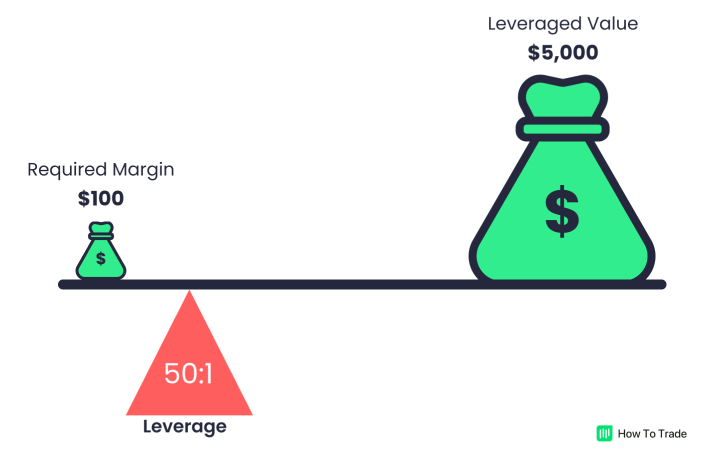

Leverage is a concept in Forex trading that allows you to borrow money from your broker to execute larger trades. It essentially amplifies your buying power and enables you to control larger positions with a smaller amount of capital. For example, with a leverage ratio of 1:1000, a $100 account can be used to make trades worth $100,000. Different brokers offer different leverage ratios, such as 1:2, 1:50, or even 1:1000.

How Does Leverage Work in Forex Trading?

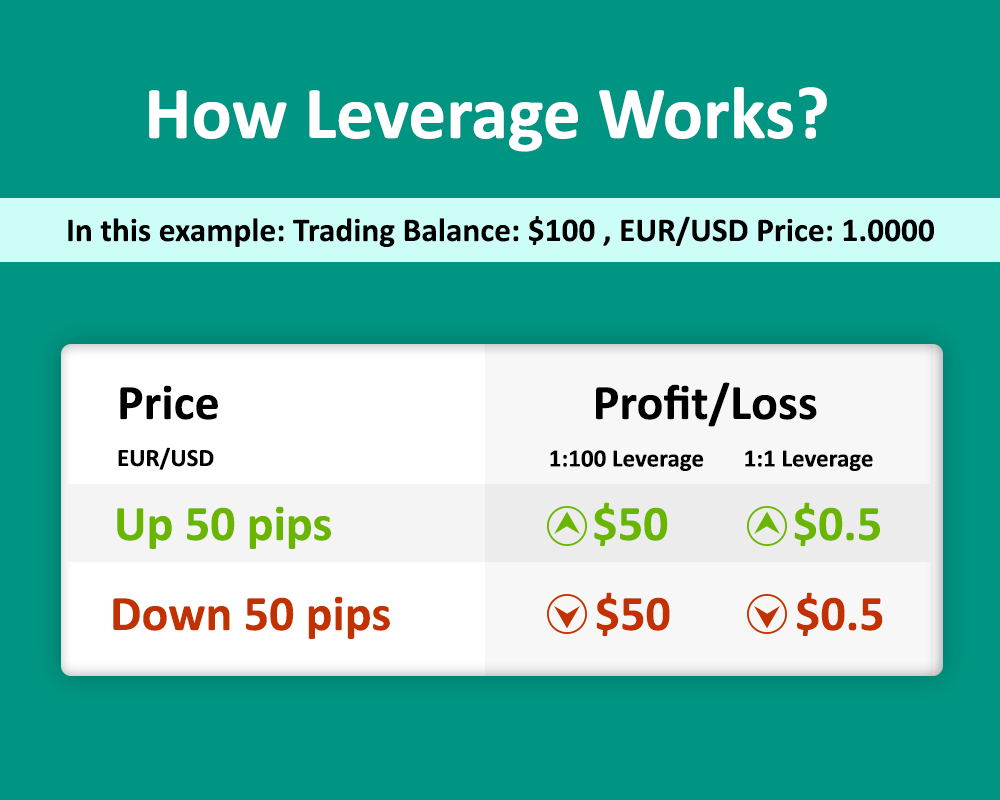

When you open a trade using leverage, you are essentially borrowing money from your broker to increase the size of your position. This means that your potential profits and losses are also amplified. While leverage can be advantageous because it allows you to turn a small account into a substantial buying capacity, it can also be risky as it amplifies both profits and losses. It is important to understand lot sizes and calculate pips to effectively manage your trades and minimize risk.

By understanding leverage and the potential risks and rewards it brings, you can make informed decisions in your Forex trading journey. Remember to always use leverage responsibly and consider the impact it can have on your trading strategy.

Different Leverage Ratios Offered by Brokers

1:2 Leverage Ratio

One of the leverage ratios offered by brokers is 1:2. This means that for every $1 that you have in your trading account, the broker will lend you an additional $2. With this leverage ratio, you can execute trades that are twice the size of your account balance.

Another leverage ratio that brokers offer is 1:50. With this ratio, for every $1 in your account, the broker will lend you $50. This allows you to trade with a much larger buying capacity compared to your account balance.

The highest leverage ratio that some brokers offer is 1:1000. This means that for every $1 in your account, the broker will lend you $1000. With such a high leverage ratio, even a small account balance of $100 can be used to execute trades worth $100,000.

It is important to note that while leverage can amplify both profits and losses, it can be a useful tool in turning a small account into a substantial buying capacity. However, it is crucial to understand lot sizes and calculate pips to manage your trades effectively. Leverage should be used responsibly and only by those who fully understand its risks and rewards.

## Advantages of Using Leverage in Forex Trading

Increased Buying Power

One of the major advantages of using leverage in Forex trading is the ability to increase your buying power. Leverage allows you to borrow money from your broker to execute larger trades than what you have in your account. For example, with a leverage ratio of 1:1000, a $100 account can be used to make trades worth $100,000. This significantly increases your potential for profits.

Ability to Make Larger Trades

Leverage also enables you to make larger trades without having to deposit a substantial amount of capital. Instead of trading with just the amount you have in your account, you can access additional funds from your broker. This gives you the opportunity to take advantage of market opportunities and potentially generate higher returns.

Potential for Higher Profits

By using leverage, you have the potential to multiply your profits. Since you can control larger positions with a smaller amount of capital, even small movements in the market can result in significant gains. However, it’s important to note that leverage also amplifies losses, so it’s crucial to be cautious and manage your risk effectively.

Using leverage effectively requires understanding lot sizes and calculating pips. It’s essential to have a good understanding of these concepts and to use proper risk management techniques.

Leverage can be a powerful tool for Forex traders. It allows you to magnify your trading potential and potentially generate higher profits. However, it’s important to approach leverage with caution and use it wisely, considering the risks involved.

## Risks Associated with Leverage in Forex Trading

Amplified Losses

Leverage in forex trading can be both advantageous and risky. While it allows you to maximize your profits, it also amplifies your losses. The larger the leverage ratio, the higher the risk of incurring significant losses. It is important to carefully manage your trades and set appropriate stop-loss orders to limit your risk exposure.

Margin Calls

Another risk associated with leverage is the possibility of margin calls. If your account balance falls below the required margin level, your broker may issue a margin call, which requires you to deposit additional funds to maintain your positions. Failure to meet a margin call could lead to the liquidation of your trades and the loss of your initial investment. It is crucial to keep a close eye on your account balance and manage your leverage levels effectively to avoid margin calls.

Limited Control

Using leverage in forex trading means you are essentially borrowing money from your broker to execute larger trades. This can result in limited control over your trading decisions, as your broker may impose certain restrictions or conditions when offering leverage. It is essential to understand the terms and conditions associated with leverage and choose a reputable broker that provides transparent information and fair trading conditions.

Remember, leverage can greatly increase your buying capacity and potential profits, but it also carries substantial risks. It is crucial to educate yourself about leverage, understand risk management strategies, and trade responsibly. With the right knowledge and careful planning, you can use leverage effectively to enhance your forex trading success.

Understanding Lot Sizes and Calculating Pips

What is a Lot Size?

When trading in the Forex market, you will often come across the term “lot size”. A lot size refers to the volume or quantity of a specific currency pair that you are trading. In Forex trading, lot sizes can vary, but the most common ones are standard lots, mini lots, and micro lots. A standard lot consists of 100,000 units of the base currency, while a mini lot is 10,000 units, and a micro lot is 1,000 units.

How to Calculate Pips

Pips are a unit of measurement in Forex trading that represent the smallest price movement of a currency pair. To calculate the value of a pip, you need to know the lot size and the number of pips the market has moved. For example, if you are trading a standard lot and the market moves 10 pips in your favor, the value of the profit or loss would be $10.

Determining the Correct Lot Size

Choosing the correct lot size is crucial in Forex trading, as it determines the amount of risk and potential profit in each trade. Factors to consider when determining the lot size include your account balance, risk tolerance, and the specific currency pair being traded. It is recommended to start with smaller lot sizes to minimize risk, especially if you are new to trading.

Understanding lot sizes and calculating pips are essential skills for successful Forex trading. Properly managing these aspects will help you make informed trading decisions and effectively navigate the market. Remember to always consider your risk tolerance and trade responsibly.

Using Leverage to Turn a Small Account into a Substantial Buying Capacity

Trading in the forex market can be an exciting and potentially lucrative venture. However, trading with a small account size can limit your buying power. That’s where leverage comes in. By using leverage, you can amplify your trading position and gain access to larger trades.

Let’s take a look at an example of leveraged trading with a $100 account. Different brokers offer different leverage ratios, such as 1:2, 1:50, or even 1:1000. With a leverage ratio of 1:1000, a $100 account can be used to make trades worth $100,000.

To successfully use leverage, it’s important to understand lot sizes and calculate pips. Lot sizes determine the volume of a trade, while pips measure the price movement in a currency pair. By understanding these concepts, you can make informed decisions and maximize your potential profits.

It’s important to note that leverage can be both advantageous and risky. While it allows you to make larger trades, it also amplifies both profits and losses. So, it’s crucial to manage your risk and trade responsibly.

Leverage can be an effective tool to turn a small account into a substantial buying capacity in forex trading. With proper knowledge and risk management, you can make the most of your trading opportunities.

## Tips for Using Leverage Responsibly

Set a Risk Management Strategy

When using leverage in forex trading, it is crucial to have a well-defined risk management strategy. Determine how much of your account you are willing to risk on each trade, and set appropriate stop-loss and take-profit levels. By doing so, you can protect your account from significant losses and ensure that your trades are based on careful analysis rather than impulsive decisions.

Avoid Overleveraging

While leverage can amplify profits, it can also magnify losses. It is important to avoid overleveraging your trades, as this increases the risk of wiping out your account. Stick to a leverage ratio that is within your comfort zone and matches your trading strategy.

Educate Yourself

Understanding the concept of leverage is crucial before using it in forex trading. Take the time to learn about lot sizes, pips, and how leverage ratios work. Educate yourself on risk management techniques, technical analysis, and fundamental analysis. The more knowledge you acquire, the better equipped you will be to make informed trading decisions.

By following these tips and using leverage responsibly, you can make the most of this powerful tool in forex trading. Remember to stay disciplined and continuously evaluate your trading strategy to ensure long-term success.

## Choosing the Right Broker for Leveraged Trading

Research and Compare Different Brokers

When it comes to leveraging in Forex trading, choosing the right broker is crucial. Start by conducting thorough research and comparing different brokers to find the one that suits your trading needs. Look for brokers with a strong reputation, good customer reviews, and competitive trading conditions. Pay attention to factors such as leverage ratios, trading costs, and available trading platforms.

Consider Leverage Ratios and Trading Costs

Different brokers offer different leverage ratios, so it’s important to understand and compare these ratios before making a decision. Leverage ratios determine the amount of borrowing power you have and can greatly impact your trading moves. Additionally, take into consideration the trading costs, such as spreads and commissions, as these can affect your overall profitability when using leverage.

Ensure Regulatory Compliance

Another crucial aspect is to ensure that the broker you choose is regulated by a reputable financial authority. Regulation provides a level of protection for traders, and it ensures that the broker operates in a transparent and fair manner. Look for brokers that are regulated in your jurisdiction or in well-established financial hubs.

By taking the time to research, compare brokers, consider leverage ratios and trading costs, and ensure regulatory compliance, you’ll be better equipped to choose the right broker for leveraged trading. Remember that leveraging can be advantageous but also risky, so it’s important to understand and manage the risks associated with it. Happy trading!

## Conclusion

Understanding Leverage is Critical

In this video, Jeffrey Benson explains the concept of leverage in forex trading. Leverage allows traders to borrow money from brokers to execute larger trades. Different brokers offer different leverage ratios, such as 1:2, 1:50, or even 1:1000. With a leverage ratio of 1:1000, a $100 account can be used to make trades worth $100,000. However, it is important to understand that leverage can be both advantageous and risky, as it amplifies both profits and losses.

Balance Risk and Reward

Jeffrey emphasizes the importance of understanding lot sizes and calculating pips when using leverage. He shows how, with the right knowledge, a small account can be turned into a substantial buying capacity. However, it’s crucial to exercise caution and manage risk. Leverage can potentially lead to margin calls and loss of funds if not used properly.

Continued Learning in Forex Trading

Jeffrey concludes the video by requesting feedback from viewers on other topics they would like to learn about. Forex trading requires ongoing learning and staying updated with market trends, strategies, and indicators. By continuously expanding your knowledge, you can improve your trading skills and make informed decisions.

Remember, leverage can be a powerful tool, but it should be used responsibly. With the right understanding and strategy, leverage can help you maximize your trading potential in the forex market.