The Opening Range Breakout Trading Strategy

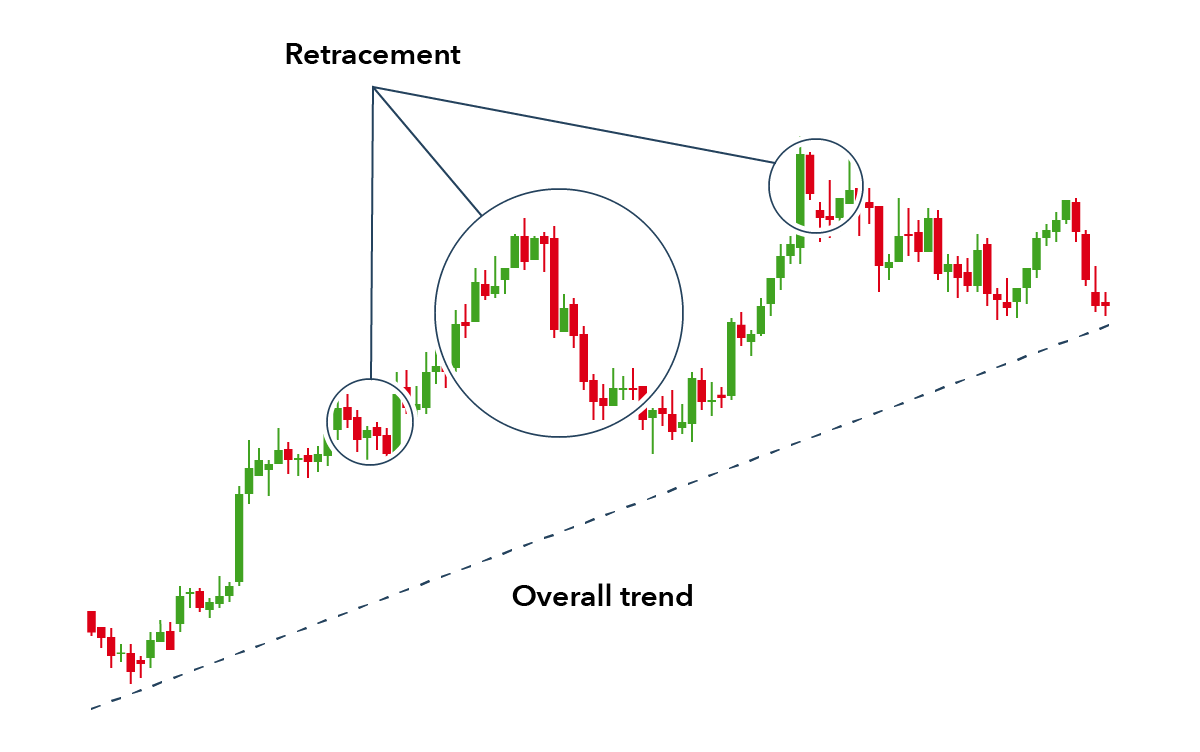

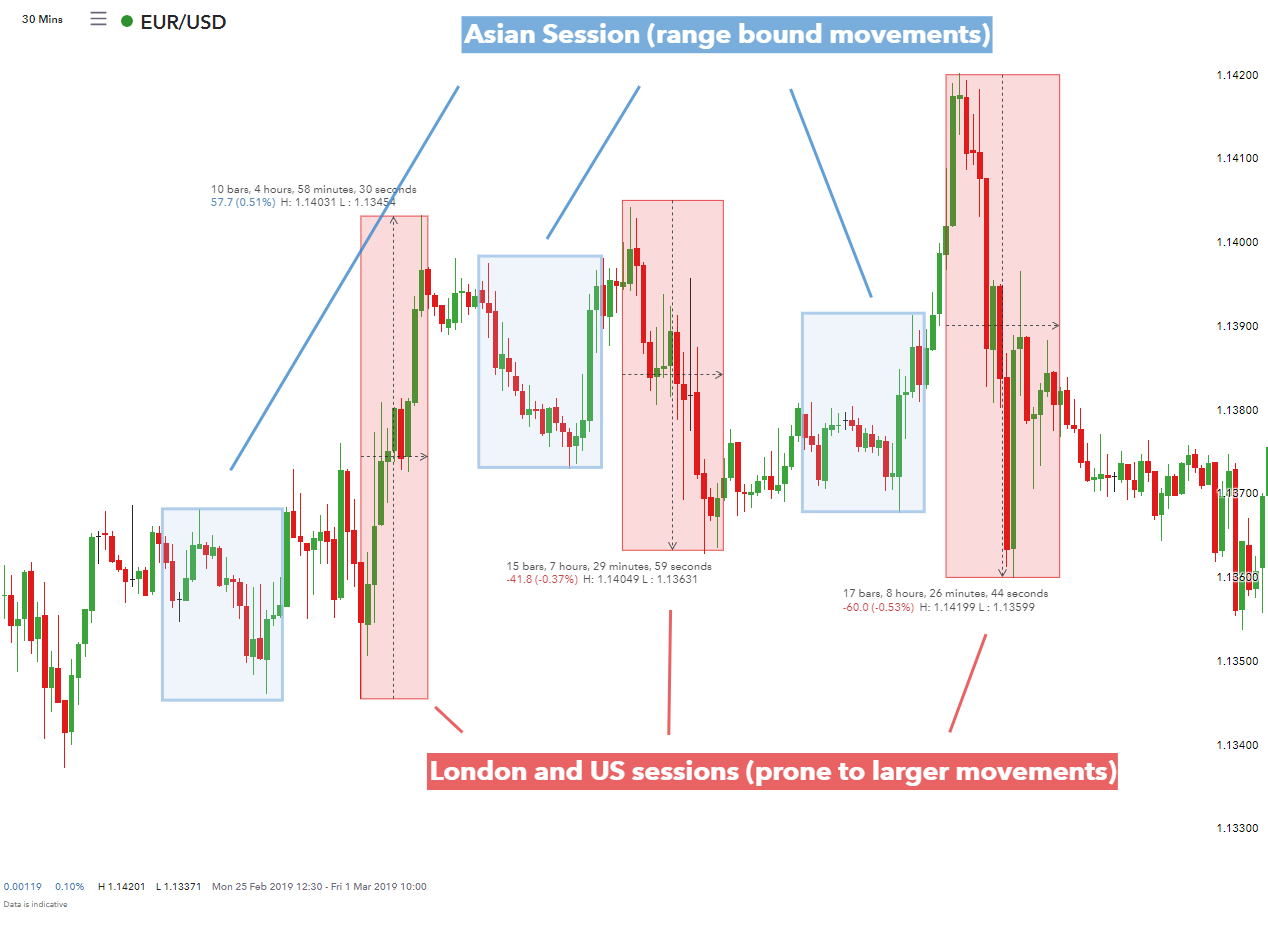

The Opening Range Breakout Trading Strategy is a popular method used by traders to identify key price levels for potential breakout trades. This strategy is particularly effective when the market is near its extreme high or low. In this post, we will focus on the European Opening Range strategy, which is designed specifically for the EURUSD pair. By identifying the high and low price levels just before the London open, you can look for a breakout of this range to trade in the direction of the flow. To successfully execute this strategy, consider using moving averages and oscillators, and pay attention to major news announcements and the time of day for optimal trading opportunities. With proper implementation, the Opening Range Breakout Trading Strategy can enhance your trading success.